Accounting support

Our specialists will handle all accounting tasks:

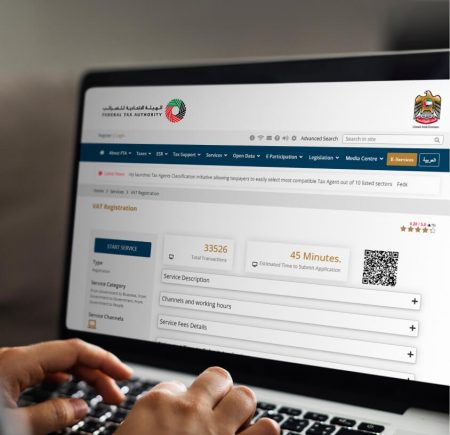

- TRN tax number registration.

- Quarterly submission of VAT returns.

- Verification of the proper format and presence of all incoming and outgoing primary documentation in line with the statements.

- Checking the accuracy of amounts in invoices and bank statements, including the correct allocation of VAT.

- Classification of income and expenditure.

- Drawing up financial reports and conducting audits for your company.

Support pricing

- The standard service package starts at $500/month.

- For an additional $2,000/year, we can assist with report preparation and auditing.

As the company that prepared the report cannot audit it, we enlist the support of our local partners. The audit cost is determined separately at the end of the year.

The price for support services will vary based on the number of transactions and the required functionalities. For instance, if you require complete accounting outsourcing, including invoicing and daily bookkeeping, the cost may increase, or decrease if you only need partial accounting support.

Our Clients' FAQ

Yes, all client payments are taken into account, even those received in foreign currency from overseas. If customers pay for your goods or services in foreign currencies, you should convert all receipts into dirhams using the UAE Central Bank exchange rate to avoid missing the deadline for applying for a TRN tax number.

Yes, all companies, regardless of jurisdiction, are required to register a TRN tax number. Even if you had no taxable transactions in the quarter and your VAT amount is zero, you are still required to file a return. Penalties apply for late registration of a tax number and late filing of a VAT return.

By law, this requirement is obligatory for all local companies. Most freezone companies are not required to do this (depending on the type of activity and the freezone itself), but an audit may be necessary for license renewal in some cases. Occasionally, economic organizations conduct random inspections. Therefore, even if you don’t plan to conduct an audit, it is essential to properly manage your documentation and use company resources strictly for their intended purpose, in case you need to report your economic activities.

Companies registered in the Emirates, whose services or turnover are subject to VAT, must register as VAT payers if the company’s turnover exceeds 375,000 AED (~$100,000). Upon reaching the specified turnover threshold, you will only have 30 days to apply for a TRN.